Dashboard

Overview

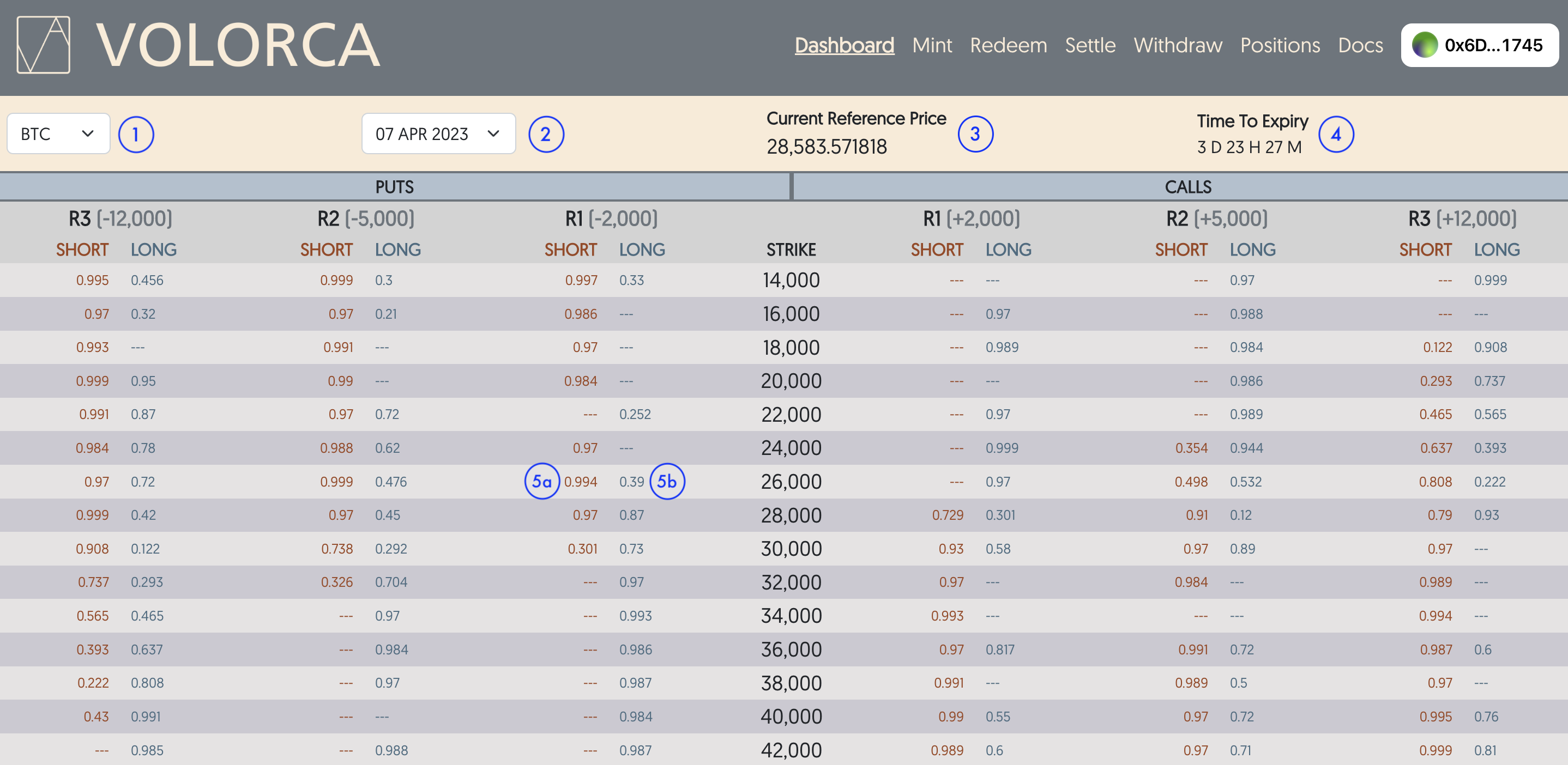

When you first enter the application, you will see the dashboard.

The dashboard is a layout of average prices of the positions tokens based on Uniswap V3 pools.

| Label | Description |

|---|---|

| 1 | Underlying asset selection. |

| 2 | Expiry date selection. |

| 3 | Current reference price of underlying asset selected in 1. Taken from the price reference policy. |

| 4 | Time left from now until expiry time. |

The prices are laid out according to their put/call type, risk intervals and short/long side (by column) and strike price (by row).

In this screenshot, 5a would be the average price in Uniswap for a SHORT position token for the instrument:

| Underlying | Expiry | Type | Strike | Risk Interval | Threshold |

|---|---|---|---|---|---|

| BTC | 2023 April 7th | PUT | 26,000 | 2,000 | 24,000 |

5b would be the average price in Uniswap for a LONG position token for the same instrument.

Note that what is displayed are the average prices.

As with order-book exchanges, the price you may eventually get will depend on the amount of position tokens you are buying or selling, as well as the available liquidity.

A deeper dive into how the Uniswap exchange works is beyond the scope of this documentation. Further details can be found here.

"---" indicates that there is no liquidity for the instrument in Uniswap. This means that there are no such position tokens being offered for purchase or sale in Uniswap.

This could mean that the instrument has not been created yet, so no position tokens have been minted, or the instrument is created, position tokens have been minted but no one has put any position tokens up for purchase or sale.

Clicking on any price (or "---") will show a popup with options to trade or perform further actions.

Pop-up

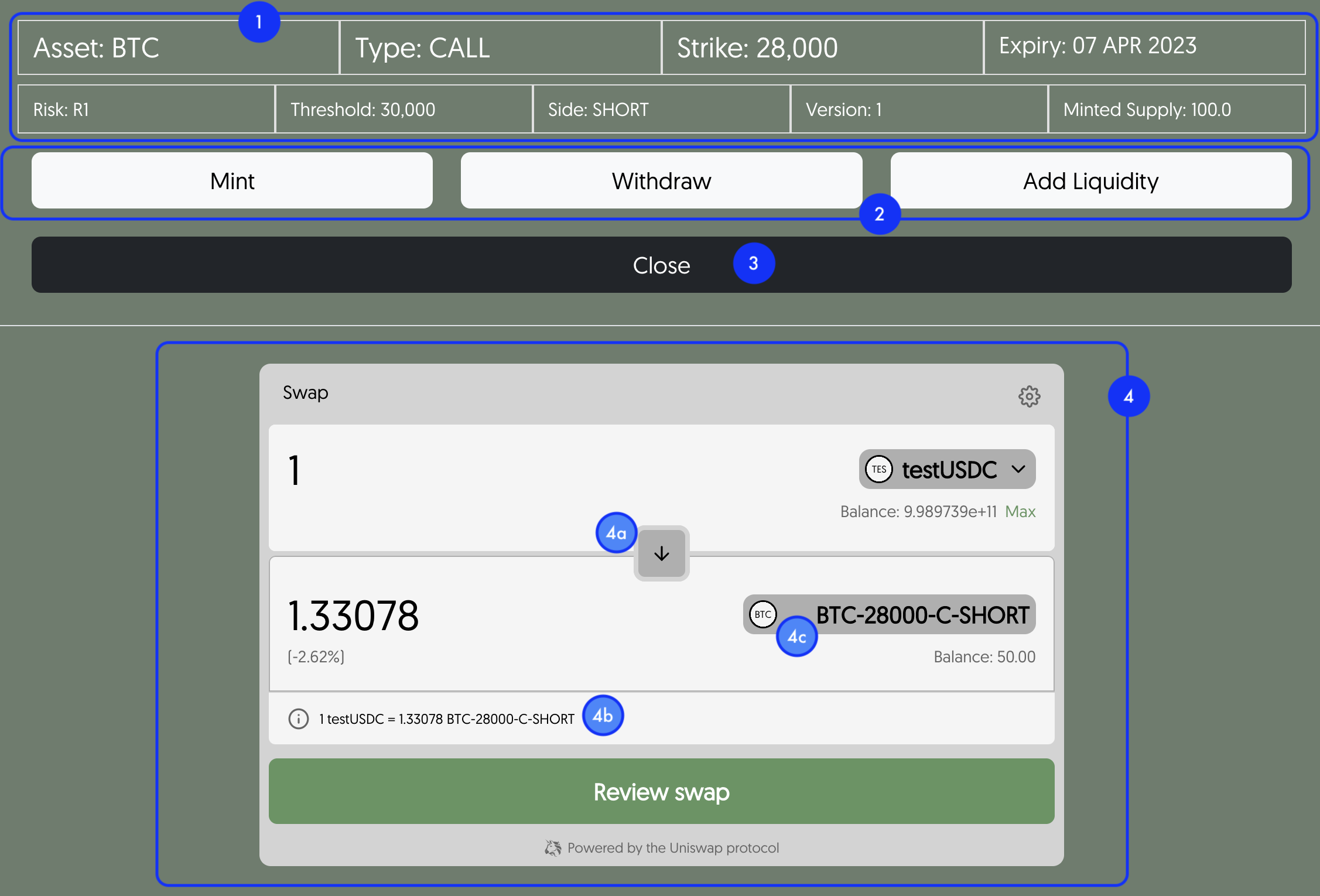

| Label | Description |

|---|---|

| 1 | Parameters for the selected position token. Minted Supply here refers to how much of each position token has been minted. In this screenshot, this means that 100 LONGs and 100 SHORTs have been minted. This also means that 100 USDC has been deposited in this instrument. |

| 2 | Available actions. Mint will take you to the minting page populated with the parameters from this instrument. Withdraw will take you to the withdrawal page populated with the parameters from this instrument. Add Liguidity will take you to the external Uniswap V3 page populated with the parameters from this position token. |

| 3 | Closes this pop-up. You may also click anywhere outside the pop-up to close. |

| 4 | Uniswap swap widget. |

Uniswap Swap Widget

The Uniswap swap widget allows you to trade position tokens with the currency token (USDC in our case).

The top value is the amount and type of token you are spending, and the bottom value is the amount and type of token you are receiving.

In this screenshot, you are spending 1 USDC to receive 1.33078 SHORT position tokens for this instrument.

Input a value in either the top or bottom boxes, and the widget will automatically fill the value in the other box accordingly.

If you wish to sell the SHORT position token instead, click on 4a to change the direction.

4b shows the conversion rate. Click on it to flip the conversion rate around.

The widget can only show a limited number of characters for each token. To clarify that the selected position token has indeed the parameters that you want, click on 4c.

This will show a display where you can view the full name of the position token. (4d)

When ready, click on Review swap, then Confirm swap and proceed to confirm the transaction in your web3 wallet.

You may need to Approve your tokens for use by Uniswap. The Uniswap widget will display the necessary buttons and instructions for you to do so.

Available Actions

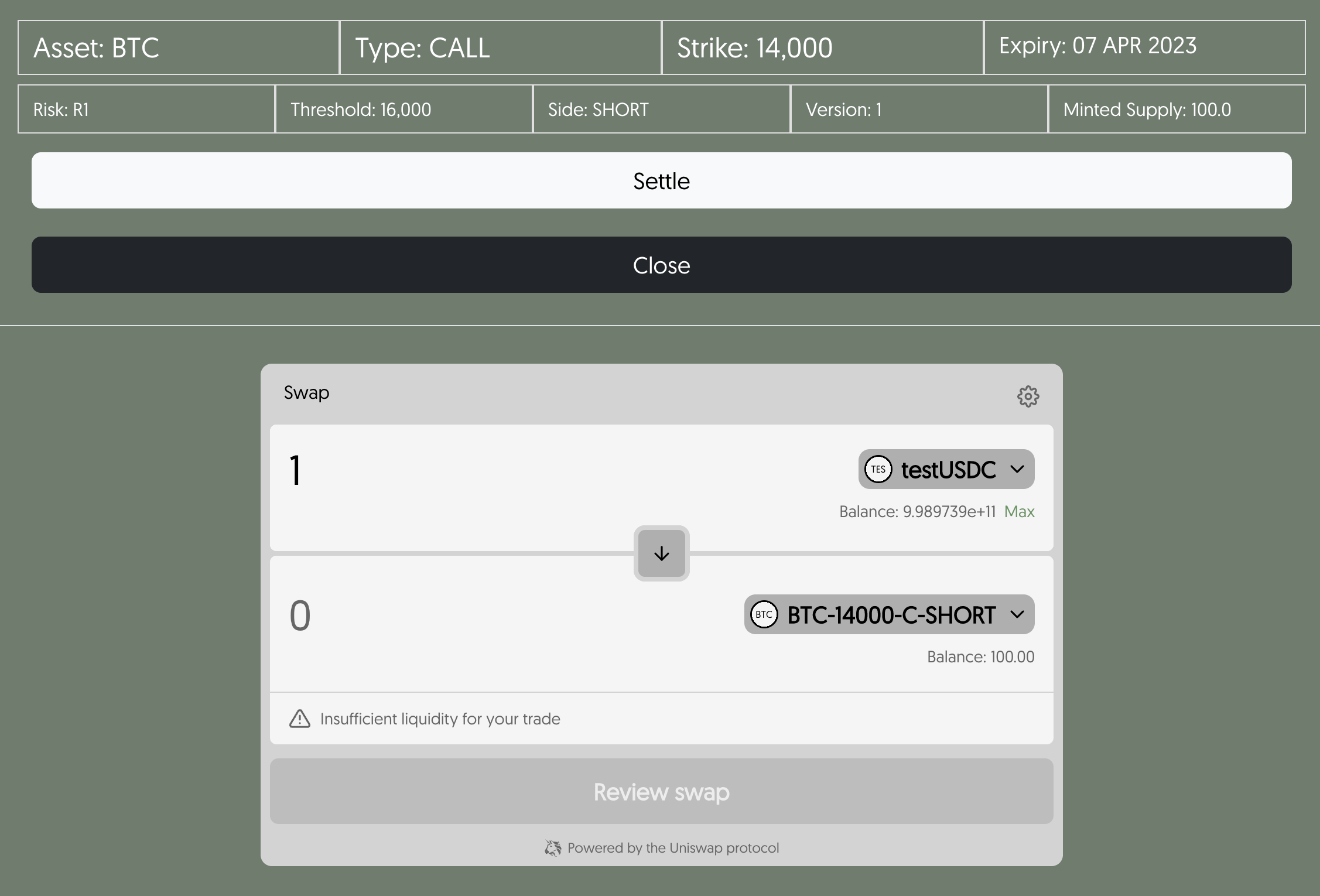

Different instruments will have different available actions.

For example, in the following screenshot, the instrument is a CALL with a strike of 14,000 and threshold of 16,000.

The current price in this case, is in the 28,000 region. This means that the instrument can be settled immediately with the "Liquidated" status.

Only the Settle button is available.

Settle will take you to the settlement page populated with the parameters from this instrument.

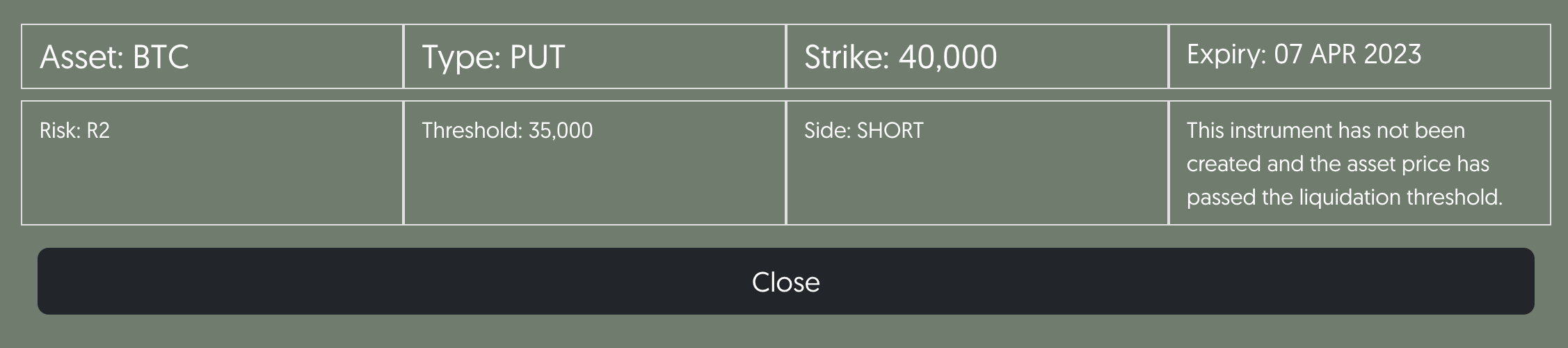

In this next example, no actions are available for a PUT with a strike of 40,000 and threshold of 35,000, that has not been created.

With a current price in the region of 28,000, this means that if the instrument were to be created, it could be immediately settled as "Liquidated". Creation of such instruments is prohibited.

Instrument

If the instrument you are looking for does not have its expiry date in the dropdown list, or if the strike price is not shown in the column of strike prices, that means it has not been created yet or it has already been settled.

To create an instrument, head over to the Mint page.

To redeem USDC from a settled instrument, head over to the Positions page. There you can view the position tokens that you hold and proceed to perform redemptions from there.